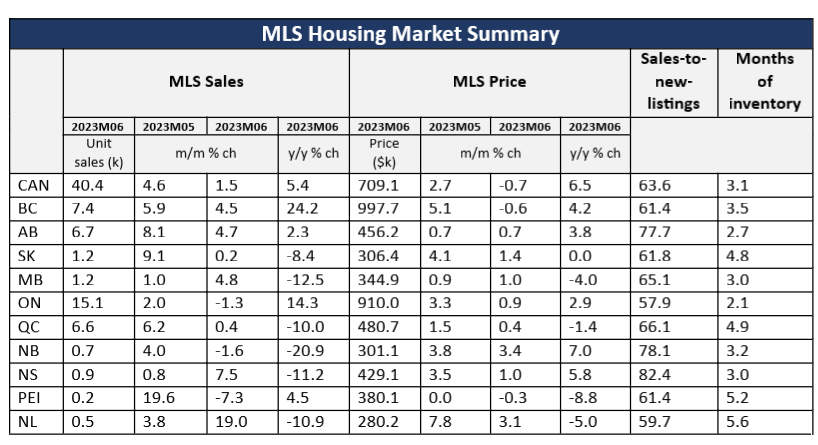

After experiencing large swings over the past year, Canadian home sales appear to be stabilizing based on the latest data from the Canadian Real Estate Association (CREA). Home sales activity was up in June in most provinces, with Newfoundland (+19.0%) and Nova Scotia (+7.5%) out front, followed by Manitoba (+4.8%), Alberta (+4.7%), and BC (+4.5%). Ontario, by contrast, saw overall sales drop 1.3%, led by a 6.9% decline in the Greater Toronto Area (GTA).

Nationally, year-over-year prices were up 6.5% in June. While this was a smaller increase than the one seen in May, it was largely a result of the outsized impact of the decline in GTA sales activity during the month. On average, seasonally adjusted prices were up in all provinces except B.C. (-0.6%) and PEI (-0.3%). Looking at these figures in the context of the longer-term trend, a recent Royal LePage report noted that prices fell nearly 30% from the February 2022 peak to the market bottom in January 2023. Aggregate prices are currently 5.6% below the 2022 peak and only 0.7% below the 2022 Q2 figure. Royal LePage expects Q4 house prices will be up 8.5% from Q4 2022, which would leave them essentially flat over the remainder of the year.

Factors underlying recent buying activity support this view on home prices. Buyers are getting mortgage funding based on rates that were locked in at the time they secured pre-approvals, which are lower than current rates. Given the rising rate rate environment, these pre-approved mortgages will fund at higher rates going forward. Affordability will be challenged, but we do not expect to see a significant decline in prices. A continued lack of supply coupled with pressure from immigration should provide a solid floor for prices. Historically, buyers have shown a willingness to step in and buy on any perceived weakness in the market – particularly in larger urban markets.

Source: Canadian Real Estate Association (CREA)

Source: Canadian Real Estate Association (CREA)

In its most recent policy statement, the Bank of Canada noted continued excess demand pressures and commented the “housing market has seen some pickup.” Including housing in this commentary is puzzling.

Housing is important for the monetary policy transmission mechanism. However, there is a lagged impact given the prevalence of five-year fixed mortgages. In this tightening cycle, variable rate mortgages (VRMs) were much more common, especially with record low rates, and borrowers could qualify under the stress test more easily with a VRM. When rates were increased, the impact on consumers should have been more immediate than most rate tightening cycles because of the greater proportion of VRMs. If rates go high enough, the rate on a VRM needs to be reset or the loan negatively amortizes – the principal balance increases due to the failure to cover the interest due on the loan.

It is our view that the central bank did not account for the ability of banks to extend amortization periods to bring these mortgages on side. With mortgage insurers accommodating these changes, VRM refinancing has largely been pushed out by 2-4 years when rates are expected to be lower. This is also the likely catalyst for OSFI’s recent move to increase the capital cost for future negatively amortizing mortgages.

The Bank’s comment on housing market activity could be seen as misdirection. Statistics Canada reported new home prices increased 0.1% in May, the first increase since August 2022, with higher labour and material costs cited as the main drivers. Looking at the house-only component of this measure, the increase was just 0.08%. While directionally this increase is a concern, it is likely not a driver of inflation.

The real concern is likely not inflation, but financial stability. Consumer debt levels are high with the debt to disposable income ratio rising to 184.5% in Q1 of 2023, from 181.7% in Q4 of 2022. At the same time, mortgage interest costs rose 29.9% in May – the highest increase on record and a 70% increase from the same period last year. In this context, the lack of any forward guidance after the second rate increase this summer underscores financial stability concerns. The Bank’s statement that “[g]overning Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation” is likely deliberately vague to avoid creating a market expectation for mortgage rates to decline.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.