CONTACT US

We’d love to hear from you

At CMI, we offer a uniquely personalized and high-touch investment experience. A dedicated Investment Account Manager works with each investor to build a customized deal profile, which allows them to tailor opportunities to each investor’s specific needs and preferences. Our program includes full-service loan administration, ensuring a seamless and hands-free investment experience.

We offer a diversified portfolio of mortgages backed by real property in a range of strong, stable real estate markets across Canada. With the flexibility to invest in a specific regional market or to diversify across regions, we work with you to build a customized portfolio.

We are exacting when qualifying investment opportunities against our rigorous lending standards, and we thoroughly analyze the regional market and its underlying fundamentals for each investment opportunity we present to you.

With more than $700M in successful mortgage placements, we are one of Canada’s fastest-growing non-bank financial services providers. With a reputation for transparency and a consistent track record of success, we offer the industry pedigree sought by discerning investors.

CMI investors can earn anywhere between 6% and 16% annually on their investments – considerably higher than the average yield of traditional fixed-income securities. Our goal is to maximize your returns based on your investment goals and preferences.

Your investment is backed by the borrower’s property, and steady, reliable monthly income is generated when the borrower makes their mortgage payments.

Mortgage investments are uncorrelated with public markets and provide a compelling opportunity for investors looking to add return potential to their portfolio without assuming additional risk.

Factors fuelling Canada’s booming real estate market have been a catalyst for remarkable growth in Quebec’s housing market, giving rise to attractive opportunities for mortgage investors. Across the province, demand for residential properties has been steadily rising. Quebec set an all-time sales record in Q1 of this year, with the sharp increase in transactions attributed mainly to the sale of plexes and condominiums across the province.

Refinance activity is further driving the home finance market as individuals direct money planned for vacation or leisure to purchase new properties or upgrade their existing homes.

Among the province’s metropolitan areas, Saguenay, Sherbrooke and Gatineau stand out as areas of greatest opportunity based on robust sales activity. Regions outside of Quebec’s metropolitan areas have also seen explosive growth across all property categories, with Mont-Tremblant, Charlevoix and Shawinigan standing out among the rest.

Both provincial and national housing market experts expect the robust market activity to continue into the foreseeable future.

British Columbia offers mortgage investors a tremendous growth opportunity. The Greater Vancouver Area continues to be one of Canada’s most desirable housing markets due to its strong local economy, rapid population growth and highly valued neighbourhoods. The provincial capital of Victoria offers many of the same benefits, with homebuyers flocking the region for its amenities and lifestyle options.

Ontario continues to offer mortgage investors a source of growth. Ottawa, the National Capital Region, is one of Canada’s most desirable housing markets due to its strong local economy, steady population growth and highly valued neighbourhoods. As the centre for government jobs, Ottawa’s housing market provides a haven during periods of economic or financial uncertainty. Optimism surrounding Ottawa real estate continues to grow as more buyers gravitate to the region from larger cities to secure more space and amenities.

Investing in Alberta’s mortgage market offers many opportunities for investors looking to generate steady returns in some of Canada’s most desirable cities. Calgary and Edmonton rank among the world’s most livable cities and are home to diverse local economies, strong population growth and a lower cost of living relative to other major metropolitan regions. A return to economic strength in the coming years is expected to boost Alberta’s housing market, including demand for private mortgages.

CMI has targeted Alberta’s major cities as a prime location for mortgage investing. CMI’s team of mortgage specialists evaluate and underwrite high quality mortgages that provide borrowers with flexible options and investors with income security and stability. Read on to learn how Alberta mortgage investing can work for you.

MORTGAGE INVESTMENTS

ANNUAL RETURN

AVERAGE LTV

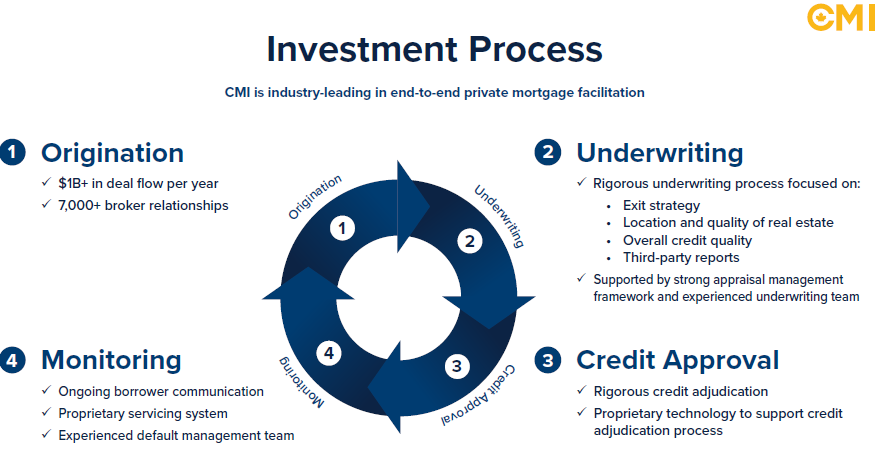

To ensure a seamless, turnkey experience, our diverse team of experts work as part of an integrated platform to manage your investment from origination to discharge.

At CMI, we offer tailored investment opportunities based on each investor’s customized investment profile. We create a portfolio that matches your capital profile and risk tolerance, diversifies your holdings and customizes your yield target, location preference and loan type.

To ensure a seamless, turnkey experience, our diverse team of experts work as part of an integrated platform to manage your mortgage investment from beginning to end.