Canadian home sales rebounded in September as prices continued to rise due to underlying supply constraints and elevated demand for residential properties. Meanwhile, the Canadian economy is showing mixed signals according to the latest data, as the lingering effects of COVID-19 restrictions continue to reverberate.

Home Sales Rise for the First Time in Six Months

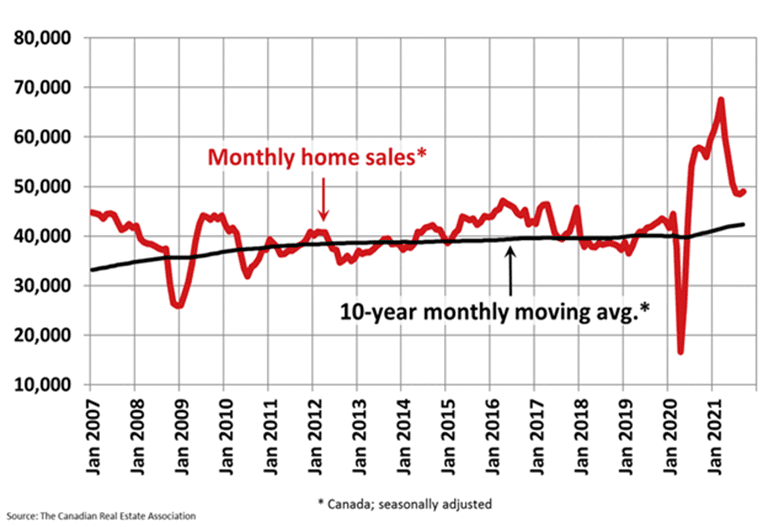

National home sales rose 0.9% in September, marking the first monthly increase since March, according to the Canadian Real Estate Association (CREA). Activity was down 17.5% year-over-year, which reflects a moderating trend from the record surge of 2020 and early 2021.

The MLS Home Price Index rose 1.7% during the month as the number of newly listed properties declined by 1.6%. As CREA noted, “There is still a lot of demand chasing an increasingly scarce number of listings, so this market remains very challenging.” By the end of September, there were 2.1 months of housing inventory across Canada, down slightly from the previous two months.[1]

When measured in sales, the housing market remains well above its long-term average. Source: CREA

Housing Affordability “Slipping Away Fast” – RBC Economics

A key measure of housing affordability from RBC worsened in the second quarter of 2021 by the greatest margin in over three decades, underscoring the supply-demand constraints in the market. RBC’s aggregate affordability metric, which measures home ownership costs as a percentage of median household income, increased by 2.7 percentage points to 45.3%, marking the fourth straight quarterly increase.

However, RBC offered at least two silver linings: first, property ownership costs are still manageable in the Prairies and parts of Atlantic Canada; second, the rate of price appreciation is slowing in many key markets, and is forecast to flatten in 2022.[2]

Employment Approaches Pre-Pandemic Level in September

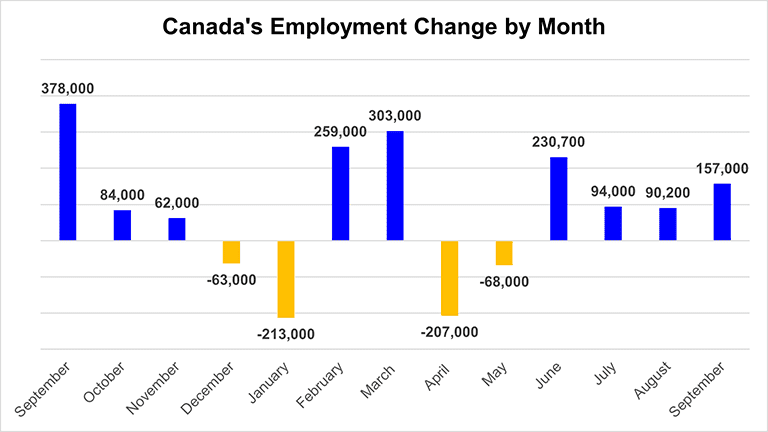

Canada’s labour market extended its recovery in September as employers welcomed back 157,000 workers, according to official government data. Full-time employment was responsible for all the gains with an increase of 194,000 from August. The unemployment rate edged down to 6.9% from 7.1%- the lowest level since the onset of the pandemic.[3]

Canada’s labour market recovery accelerated in September. | Data source: Statistics Canada.

Volatility Returns to the Stock Market

Wall Street and Canadian stocks have experienced renewed volatility over the past month, as concerns about the economic recovery and monetary policy weighed on risk sentiment. However, the major indexes appear to have turned a corner in recent weeks, with Toronto’s benchmark TSX Composite Index climbing back towards all-time highs.

The TSX Composite has recovered more than 900 points from its October bottom. | Source: barchart.com

CMI Financial Group’s Mortgage Portfolio Expands in Q3

Funding continued to grow across CMI Mortgage Investments for the quarter ending September 31st. Total lifetime funding reached $970M, with assets under management of more than $475M. Our lending footprint continued to expand across Canada with a strong focus on risk management and capital preservation. The arrears rate across the entire portfolio was below 3% and the loss rate was negligible at less than .5%.

CMI’s MIC portfolios grew considerably in the third quarter, underscoring heightened demand for specialized mortgage investments. CMI’s flagship Balanced Mortgage Fund saw total investors surge by 26% from July to September. The Fund generated a net annualized yield of 8.43% for investors over the quarter.

CMI’s High Yield Opportunity Fund also registered considerable growth, offering investors a net annual yield of 10.43% over the quarter. The more conservative Prime Mortgage Fund generated a net annual yield of 6.33% over this same period.

Conclusion and Summary

Canada is beginning to flatten the curve on COVID-19 following successful vaccine rollouts across the country. While Canada remains locked in a fourth wave, the seven-day average for infections has declined considerably in October. Nationwide, the seven-day average for infections has been on the decline since mid-September.[3]

What Happens Next?

CMI Financial Group will continue to analyze market changes and keep you updated on a regular basis.

Learn more about investing in private mortgages.