The Canadian economy, and by extension, the housing market continued their post-shutdown recovery in August. The devastating job losses of March and April are in the process of reversing as more segments of the economy reopen and children head back to school.

A rebounding economy and record-low interest rates have been a boon to the housing market, which set a new sales record in August. As CMI reported last month, the housing market appears poised to continue its recovery through the early fall as economic conditions continue to improve.

Home Sales, Property Values Continue to Rise

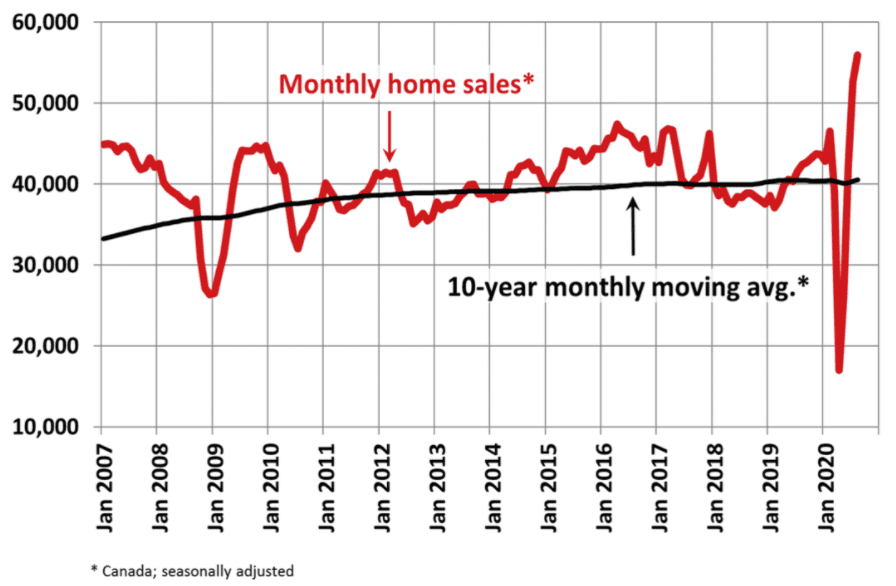

August was the busiest month for home sales in recent memory, according to data from the Canadian Real Estate Association (CREA).

CREA, which represents more than 130,000 Realtors across the country, reported 58,645 home sales in August. That reflects an annual gain of 33.5%. On a monthly basis, national home sales rose 6.2% and the average national sale price surged 18.5% annually.

Caption: Canadian home sales have more than recovered from their pandemic-induced declines. | Chart: CREA

Despite the strong rise in sales, real estate activity was not uniform across the country. Sales rose in roughly 60% of local markets, with the Greater Toronto Area and British Columbia’s Lower Mainland leading the way.

Labour Market Recovery Continues

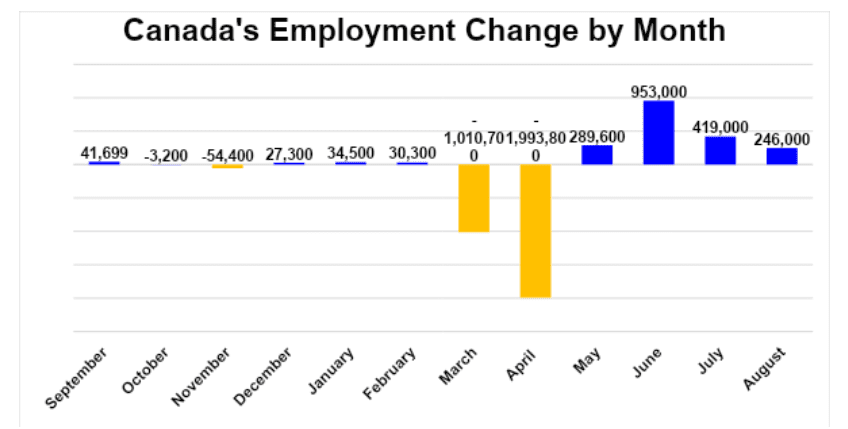

Although Canada’s labour market continued its upward climb in August, the pace of job creation slowed significantly from the previous two months.

Employers added 246,000 workers to payrolls in August as the unemployment rate fell 0.7 percentage points to 10.2%. There were still 1.1 million fewer people employed in August than in February, before the government lockdowns began.

Caption: The Canadian economy has regained more than 1.9 million jobs over the past four months. | Source: Statistics Canada

The latest Statistics Canada data also showed fewer Canadians working from home than in previous months. In April, 3.4 million people worked their usual hours from home due to the lockdown. By August, that number had fallen to 2.5 million.

BMO: Full Economic Recovery Expected

The Bank of Montreal’s latest forecast on residential construction shows favourable conditions heading into 2021, as technology, manufacturing, warehousing and public infrastructure continue to recover. BMO’s economists expect the Canadian economy to make a full recovery in 2021.

Housing starts are forecast to rebound to 215,000 units in 2021, up from 195,000 this year. That puts the housing market on track to exceed 2019 levels.

BMO forecasts Canada’s gross domestic product to rise 6% in 2021—reversing the 6% slump expected for this year.

Doug Porter, BMO Financial Group’s chief economist, explained why the bank is less pessimistic than others:

“We have a long way to go yet. But the most negative predictions have not been borne out. People want to get back to work, they want to get back to as close to normal as possible. We have seen it, people want to get out and spend again.”

Stock Market Sees Renewed Volatility

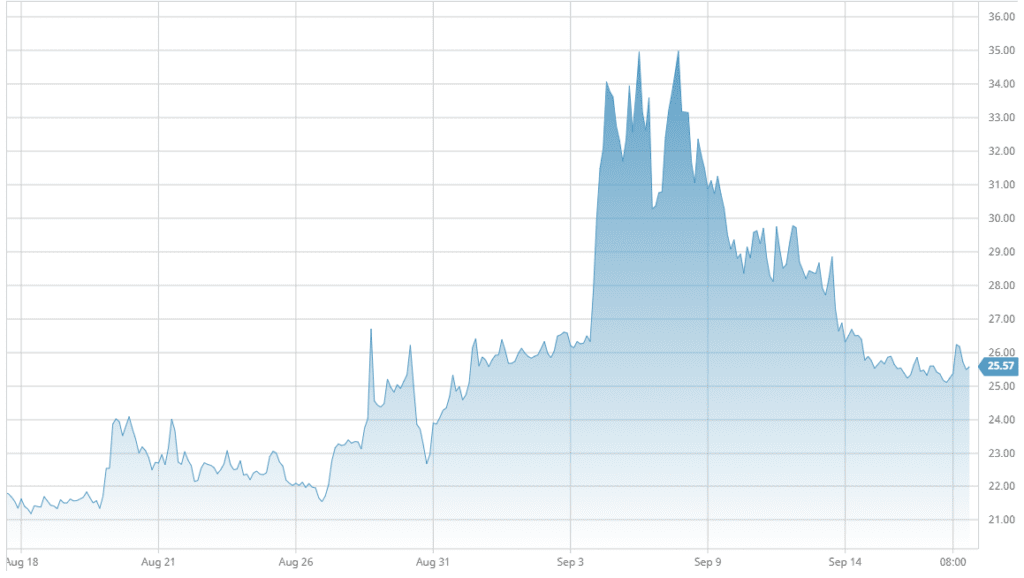

An overheated tech sector drove U.S. equities to record highs at the beginning of September, but the rally quickly unraveled.

In a span of just three trading days, the technology-focused Nasdaq Composite Index plunged 10%, marking its fastest correction in history. The benchmark S&P 500 Index declined 7% over the same stretch, while the TSX Composite Index fell 3.5%.

Caption: The CBOE Volatility Index, commonly known as the VIX, spiked in early September. It has leveled off a bit in recent weeks but continues to trade above the historical average—a sign investors are bracing for volatility in the month ahead. | Chart: barchart.com

A combination of valuation risks, economic instability and uncertainty over the delivery of a Covid-19 vaccine contributed to the selloff.

Although risk appetite seems to be returning, investors are still hedging their bets with alternative investments, foreign equities and precious metals.

Amid the volatility, Canada’s residential real estate market remains relatively stable, as evidenced by the latest data on home sales. CMI invests in residential mortgages in highly desirable urban centres across Canada. The CMI Mortgage Investment Corporation (MIC) funds target net annual returns of 6%-11%, comprised of highly liquid assets.

The Bottom Line

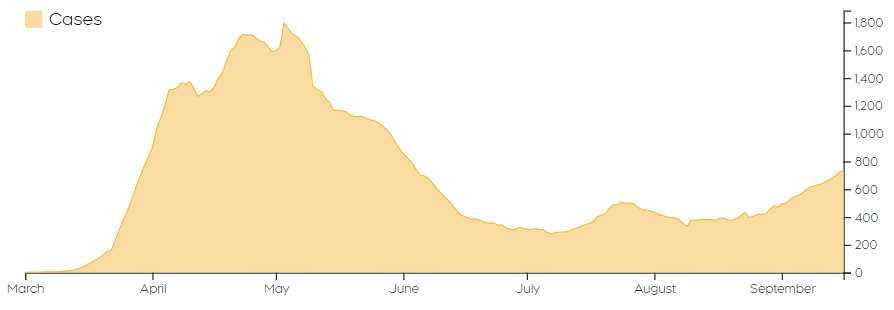

Although Canada’s economic recovery appears to be on track, a resurgence in Covid-19 cases threatens the outlook. British Columbia, Ontario and Quebec have all reported a sharp uptick in new virus cases months after each province eased shelter-in-place orders.

Caption: New Covid-19 cases in Canada are on the rise again, especially in B.C., Ontario and Quebec. | Source: CTV News

Against this backdrop, alternative investments in the residential mortgage market could protect investors from turbulence in the months ahead.

Beyond the Covid-19 crisis, the U.S. presidential election is another source of uncertainty for investors. CBOE VIX Volatility futures point to turbulent trading conditions in October and November. A contested election could impact asset prices, even in Canada, where equity markets often track their U.S. counterparts.

What Happens Next?

CMI will continue to analyze market changes and keep you updated on a regular basis. To learn more about our investment opportunities fill out the contact form below, and one of our Investment Managers will reach out to you within 24 hours.