Real estate activity weakened slightly in November, but remained elevated compared with year-ago levels, signaling once again that the Canadian housing market stands on solid footing. The outlook on the broader economy is somewhat mixed in the short-term as regions cope with a renewed surge in COVID-19 cases. Beyond the immediate term, however, relief appears to be on the way as federal authorities gear up to distribute COVID-19 vaccines.

Canada’s Housing Market: By the Numbers

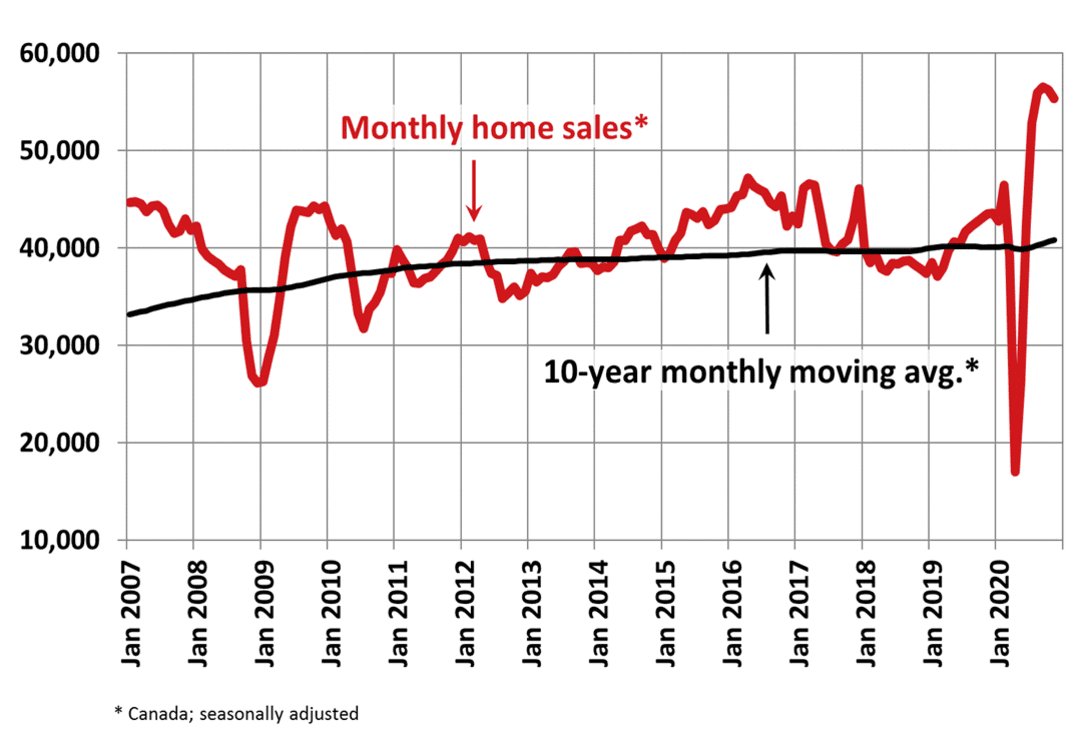

Canadian home sales edged lower in November, as the market continued to unwind from its record-setting pace through the summer. Nation-wide home sales fell 1.6% in November, though activity was up 32.1% annually, according to the Canadian Real Estate Association (CREA).

Home sales continued to moderate in November but remain well above the historical average. | Source: CREA

Roughly 60% of all local markets reported a decline in sales, led by Toronto, Vancouver, Montreal, and Ottawa. Although the demand for single-family homes remains robust in these markets, as the work-from-home trend has pushed more workers to the suburbs. This also resulted in weakened demand for high-rise condos in dense urban centres.

Nation-wide, the number of newly listed properties also edged down 1.6% in November. Despite the modest pullback in sales, home values increased 1.2% on month and 11.6% annually.

Job Recovery Weakens

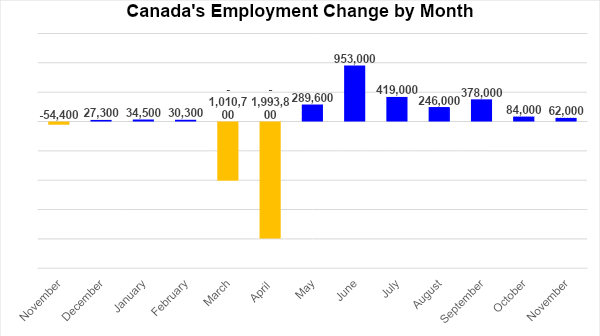

November marked the seventh consecutive month of job creation for Canada, but just like October, the pace of hiring continued to weaken in the wake of renewed COVID-19 restrictions. Employers added 62,000 workers to payrolls during the month, the weakest pace of hiring since the post-crisis recovery began in May.

As Statistics Canada reported, employment rose by just 0.3% in November compared with an average monthly gain of 2.7% between May and September. Meanwhile, the number of Canadians working from home increased by approximately 250,000 from October to 4.6 million.

The Canadian labour market is in recovery mode, but the pace of expansion has slowed significantly. | Data from Statistics Canada.

Unemployment continues to decline from record levels. The jobless rate fell 0.4 percentage points to 8.5% in November after peaking at 13.7% in May.

Home Values Expected to Rise in 2021: CREA

2021 is shaping up to be a strong year for Canadian real estate, as supply shortages and a rebounding economy are predicted to drive demand for residential real estate. CREA believes national average house prices will increase by 9.1% to $620,400 in 2021, led by gains in Ontario and Quebec. Home values are also expected to rise in Alberta and Saskatchewan following several years of depreciation.

In a news release that was published in mid-December, CREA said:

“Current trends and the outlook for housing market fundamentals suggest activity will remain relatively healthy through 2021, with prices either continuing to climb or remaining steady in all regions.”

A separate report from Royal LePage anticipates that Canada’s most expensive housing market – Greater Vancouver – will return to strength following three years of stagnation. The brokerage firm forecasts home values in the region to rise 9% in 2021.

Equity Markets Rally on Vaccine, Stimulus Optimism

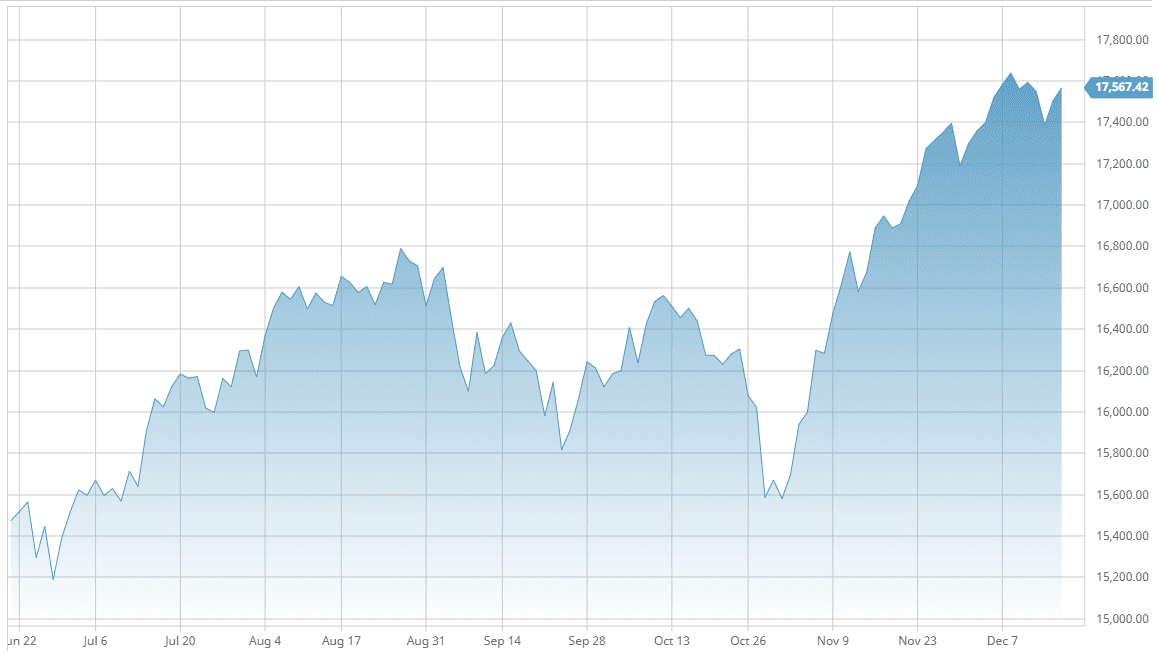

North American stocks rose through mid-December, as investors rallied behind the news of a coordinated vaccine rollout in the United States and Canada. Progress towards a new U.S. stimulus deal also supported risk-on sentiment.

The S&P 500 and Nasdaq Composite Index touched new all-time highs in December. Meanwhile, the TSX Composite Index came within 2% of a new record close. By mid-December, the Canadian benchmark had reversed losses for the year and was up 3% for 2020.

The TSX Composite Index has rebounded 56% from its March low. | Source: barchart.com

Meanwhile, the U.S. dollar has declined sharply throughout the month and is on pace for its worst fourth-quarter performance in 17 years. The U.S. dollar index, which tracks the performance of the greenback against a basket of six rivals including the loonie, is down 4% in the fourth quarter and over 12% from its March peak. The Canadian dollar touched two-year highs against the greenback in early December before experiencing a sharp pullback later in the month.

Conclusion and Summary

Many investors are looking forward to concluding an extremely volatile and unpredictable 2020. The COVID-19 pandemic triggered a chain of unprecedented events for the global economy. Governments and central banks responded by unleashing waves of fiscal and monetary stimulus, the benefits of which are still resonating in the stock market. Canadian real estate ends the year on solid footing and appears poised to continue its uptrend in 2021 as more segments of the economy come back online. In the meantime, demand for alternative lending solutions remains high.

What Happens Next?

The CMI Group will continue to analyze market changes and keep you updated on a regular basis. Visit our website to learn more. Learn more about investing in private mortgages.