Canada’s housing market remained on ice in May, but key segments from Toronto to Vancouver showed notable improvements even as provincial governments extended shelter-in-place orders. Although the Canadian economy is not expected to see a ‘V-shaped’ recovery, real estate demand is proving to be quite resilient.

Canada’s Housing Market: By the Numbers

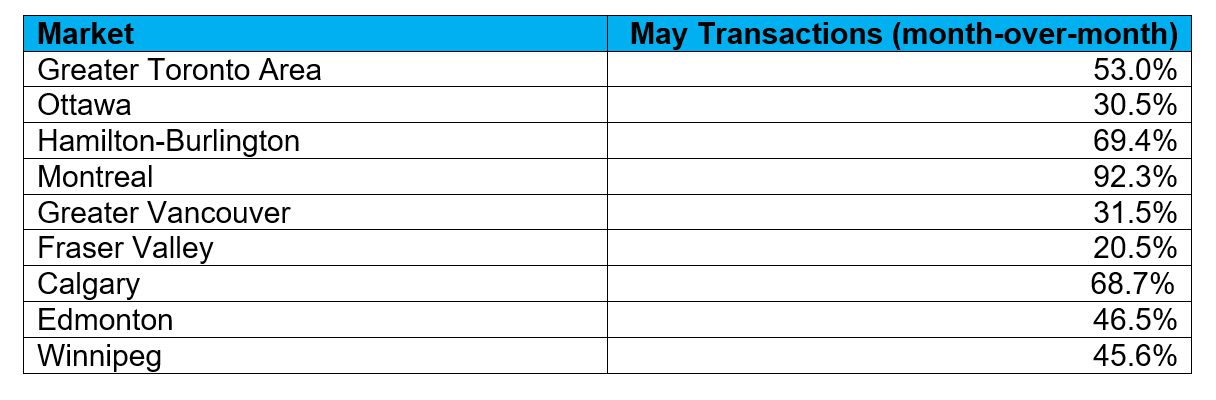

Residential real estate saw notable improvements in May, though the industry as a whole remains below pre-pandemic levels. National home sales jumped 56.9% in May but were still down 39.8% on a year-over-year basis, according to the Canadian Real Estate Association. New listings rose 69% month-over-month, though actual new supply was down 38.1% annually.

Source: CREA

Big Employment Rebound

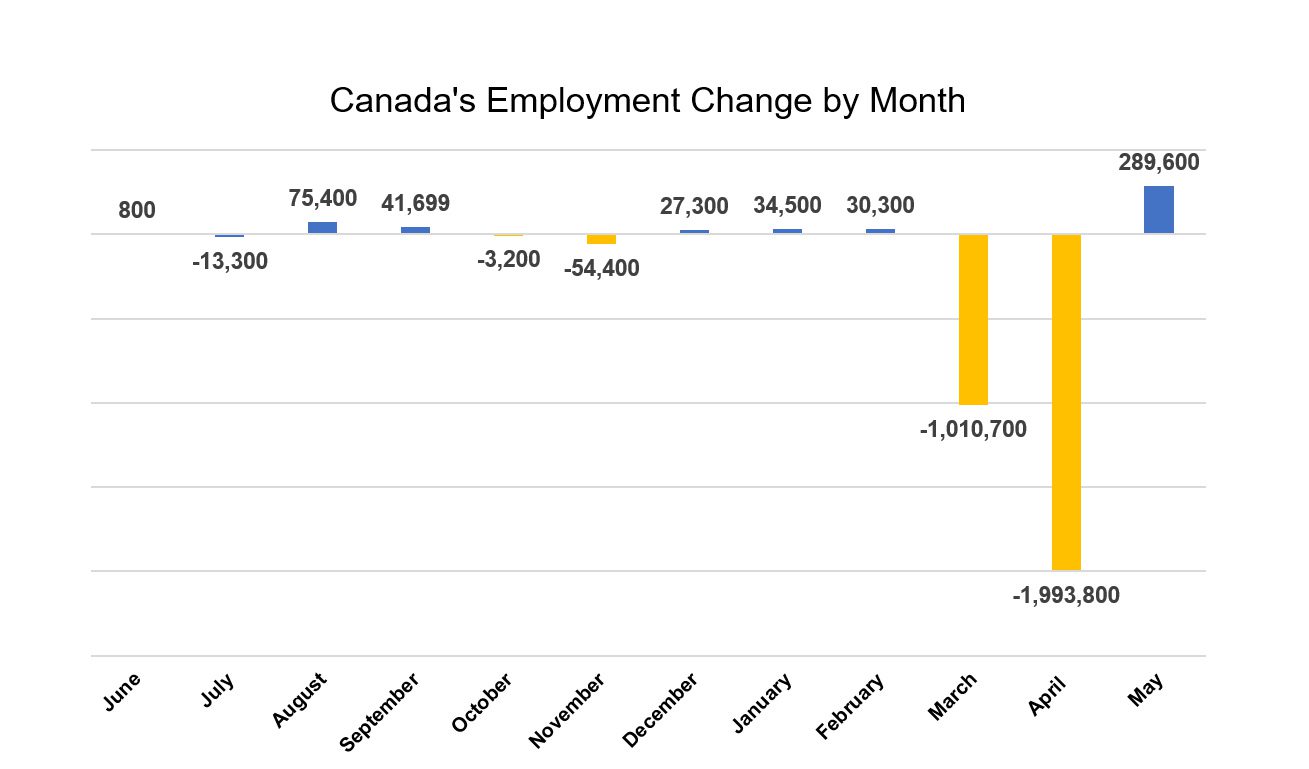

The Canadian economy added 290,000 jobs in May, the biggest one-month gain in 45 years, offering some reassurance that post-coronavirus recovery would be swift. Fallouts from the world-wide pandemic caused paid employment to decline by more than three million in March and April.

Canada’s labour market shows partial recovery amid the pandemic. | Source: Statistics Canada

Although Canada’s unemployment rate rose to a record high in May, jobs began returning to the market resulting in a positive change.

The health of the labour market is paramount for real estate activity. As more people return to stable work environments, demand for homeownership will grow, especially with interest rates at all time lows.

Housing Market Has Already Bottomed: RBC

Although the impact of COVID-19 on housing has been swift and painful, the worst has likely passed, according to RBC senior economist Robert Hogue.

Hogue called the market bottom last month when he told clients that “April could prove to be the cyclical low point for home resales.” In his view, the risk of significant price declines is low outside of markets where home values were declining before the pandemic.

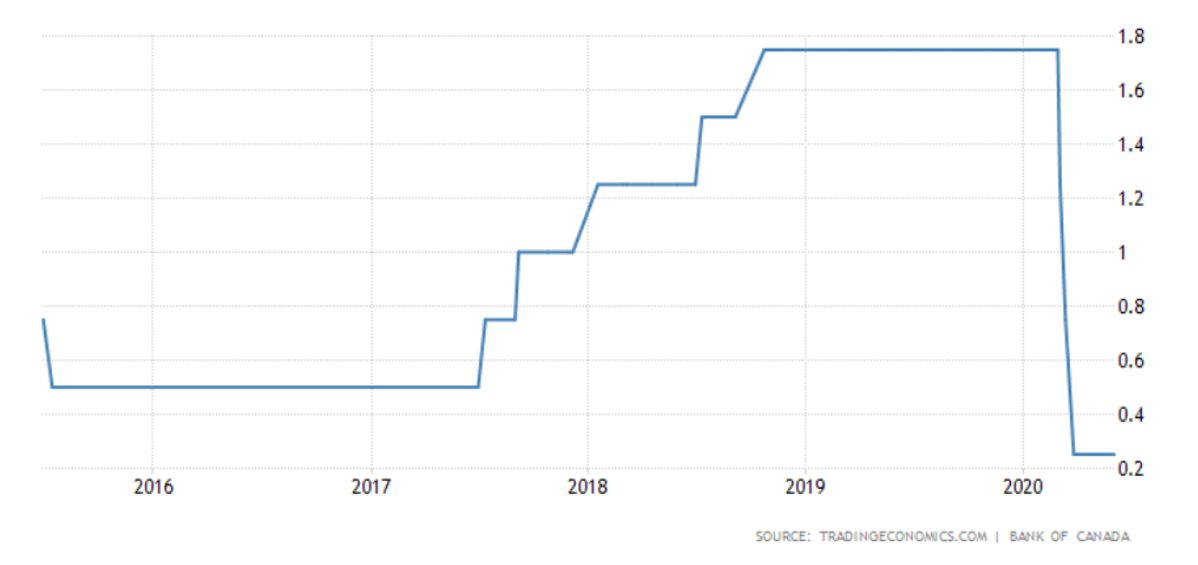

A rebounding economy and fresh stimulus measures from the Bank of Canada (BOC) are expected to keep the housing market from declining any further. The BOC responded to the COVID-19 crisis by slashing interest rates by a cumulative 150 basis points and announcing several asset-purchase programs. The coordinated policy response will increase access to credit and provide financial markets with much-needed liquidity.

Canadian interest rates are back to record lows. | Chart: TradingEconomics.com

Monetary policy impacts mortgage rates indirectly as banks pass on interest savings to consumers. Since early March, the average five-year fixed-rate mortgage in Canada has declined by 25 basis points.

Investing During Recession

Canada’s economy plunged into recession in the second quarter, as COVID-19 forced the nation into lockdown. Although the economy is expected to rebound in the second half of 2020, returning to pre-crisis levels could take years to play out. In the meantime, investors can expect traditional assets such as stocks and bonds to experience significant volatility.

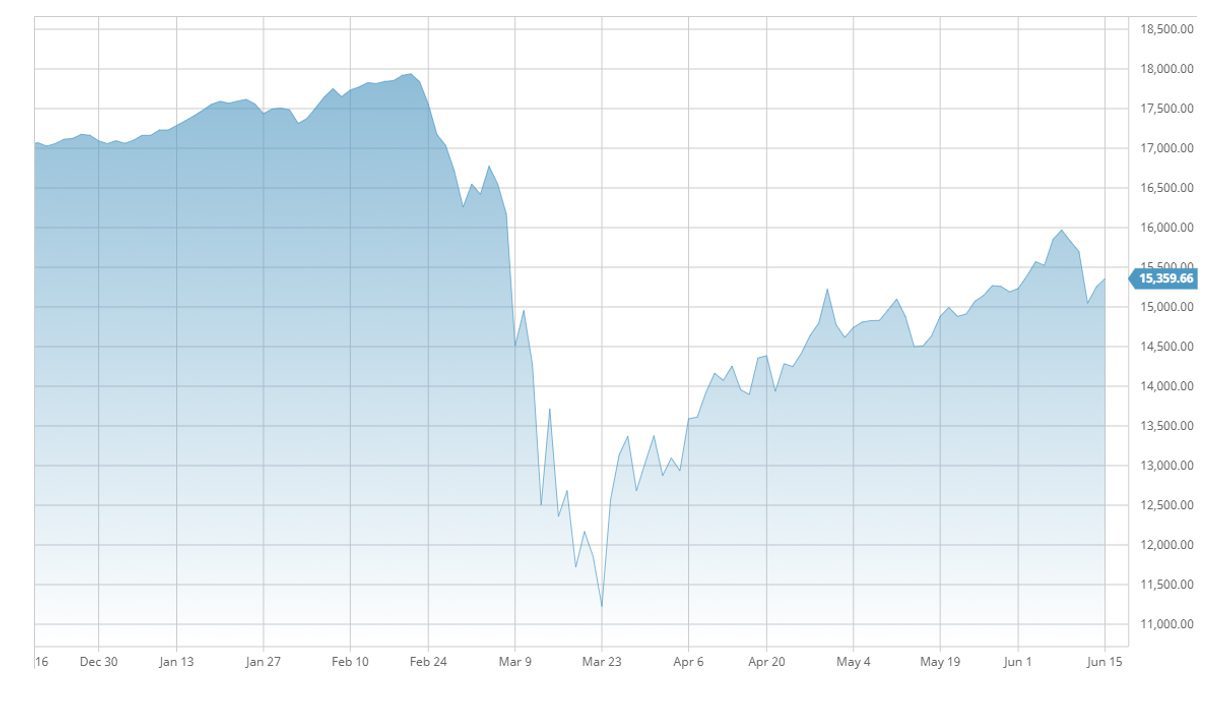

On the equities front, the S&P/TSX Composite Index extended its relief rally in May but has faced renewed volatility this month. The benchmark index is still down more than 14% from its pre-pandemic high.

The TSX has recovered from its pandemic low but remains well off its February high. | Source: barchart.com

The CBOE Volatility Index, a measure of implied volatility in the U.S. stock market, rose sharply in the second week of June. The indicator remains well above the historic mean, which suggests investors are expecting more turbulent conditions over the next 30 days.

Mortgage investing provides an alternative, defensive strategy for investors looking to hedge against volatility. As the housing market data indicate, real estate activity is already in the process of rebounding from the pandemic. Canadians still want to buy homes and are more likely to do so in an environment of record-low interest rates.

CMI continues to invest in residential mortgages through our dedicated Mortgage Investment Corporation (MIC). The MIC targets net annual returns of between 8% and 9%, and is comprised of highly liquid assets across Canada’s most desirable real estate markets.

The Bottom Line

Canada’s post-pandemic recovery is expected to play out over many years, but residential real estate appears to be getting back on track quickly. The key to the continued recovery will be the labour market. As more Canadians return to work, record-low interest rates will further incentivize homebuying.

Contact our Investment Managers today to discuss your options for investing with CMI!