When it comes to evaluating the financial health of your clients, few documents matter more than the credit report. Although credit reports appear straightforward at first glance, there’s a lot more that goes into the rating system than meets the eye.

A credit bureau is a company that collects information regarding an individual’s credit history and uses that information to tabulate whether they are a high-risk, moderate-risk, or low-risk borrower. The credit bureau’s main task is to keep tabs on an individual’s credit rating and to help lenders assess their clients’ creditworthiness.

In Canada, there are two main gatekeepers of the credit-rating business: Equifax and TransUnion. These two credit bureaus pervade every major financial institution in the country. Whether an individual is applying for a credit card, car loan, or mortgage, lenders usually tap either Equifax or TransUnion to run the credit report.

It’s important to point out that lenders are not obliged to report account information to either of the credit bureaus. They do so voluntarily, which suggests they rely on the credit rating system to evaluate their clients. Ultimately, it is the lender who decides whether to lend money based on their own guidelines.

What’s Included in a Credit Report?

A credit report is not merely the collection of an individual’s credit history; rather, it provides detailed information that allows lenders to form a judgement about a borrower’s creditworthiness.

A credit report includes the following information about a borrower:

- Personal information (name, address, date of birth, social insurance number)

- Credit history (types of credit obtained, loan amounts, and outstanding balances)

- Inquiries (how many times lenders have asked about an individual’s credit history)

- Public records of collections, judgments, bankruptcies, and consumer information.

Equifax and TransUnion also integrate FICO scores, also known as Beacon scores, from U.S. analytics company Fair Isaac Corporation. According to Fair Isaac Corporation, 90% of Canadian lenders use their score to evaluate customers. Lenders, however, are contractually obligated not to share their Beacon scores with the customer. A Beacon score can only be accessed with a “hard” credit check. Because “hard” checks are considered inquiries, they can have a negative impact on an individual’s credit score.

All this information is leveraged by lenders to determine how much credit an individual qualifies for based on their ability to pay. In other words, it’s a credit risk assessment that allows financial institutions to assign appropriate interest rates and fees on their loans. The credit report is also used by banks and insurance companies to identify consumers who are more likely to buy their products and services.

Although most credit reports provide accurate information, they often contain faulty or incomplete data. This information should be cleared up with the credit bureau as soon as possible to ensure that it doesn’t negatively impact an individual’s ability to obtain credit.

How Are Credit Scores Tabulated?

One of the ways credit bureaus have become indispensable to traditional lenders is through the credit scoring system. A credit score is a three-digit number that provides a static snapshot of an individual’s creditworthiness. The higher the score, the more favourable the borrower appears to lenders. It is up to the lender to determine what minimum score is needed to borrow from them.

In Canada, credit scores typically range from 300 to 900. While the credit bureaus do not disclose their scoring methodology, the score is based on a weighting of various criteria, including payment history (35%), amount owed versus available credit (30%), length of history (15%), public records (10%), and inquiries (10%). This means payment history has the largest impact in how a credit score is tabulated (changes in this category have three times the impact on a credit score than an individual inquiry, for example).

In practice, an individual’s credit score is impacted by whether they pay their bills on time, how many new credit accounts they opened, how much is currently owed on revolving accounts like credit cards, the length of the accounts, and whether judgements, collections, bankruptcies, or consumer proposals have been initiated.

The payment history category, which has the biggest impact on credit scores, is reported every month. Lenders assign borrowers a score of 0 to 9 based on the type of credit being used:

- “R”: Revolving credit (payments contingent on the borrower’s account balance)

- “O”: Open (this includes opened credit, such as student loans or lines of credit)

- “I” Installments (the loan is being repaid over a certain period)

- “L”: Lease account

- “M”: Mortgage

The ratings are used to indicate the nature in which a borrower repays their debt.

The following chart highlights the “R” rating system and how it’s interpreted by lenders.

| Rating | Description |

| R0 | Too little credit history or credit unused. |

| R1 | Account is paid back in full within 30 days |

| R2 | Account is paid more than 30 days past the due date, but not more than 60 days late. |

| R3 | Account is paid more than 60 days past the due date, but not more than 90 days late. |

| R4 | Account is paid more than 90 days past the due date, but not more than 120 days late. |

| R5 | Account is paid more than 120 days past the due date, but has yet to receive an R9. |

| R6 | N/A |

| R7 | Account holder enters debt relief and makes agreed upon payments. |

| R8 | Repossession. |

| R9 | Account in collections or bankruptcy. |

Source: Adapted from loanscanada.ca

The following chart provides a breakdown of the “I” ratings:

| Rating | Description |

| I0 | Too little credit history or credit unused. |

| I1 | Considered a one-time payment. |

| I2 | Payment was late by 30 days. |

| I3 | Payment was late 60 days. |

| I4 | Payment was late 90 days. |

| I5 | 120+ days of late reporting |

| I6 | N/A |

| I7 | Account holder is making a consolidated debt payment. |

| I8 | Repossession |

| I9 | Account either in collections, bankruptcy or is considered uncollectible |

Chart adapted from jrwtopbeacon.com

Late payments are especially damaging because they can stay on a credit report for up to six years. This is also known as a “previous high rate,” and can remain on a credit report even if the borrower pays the past-due balance.

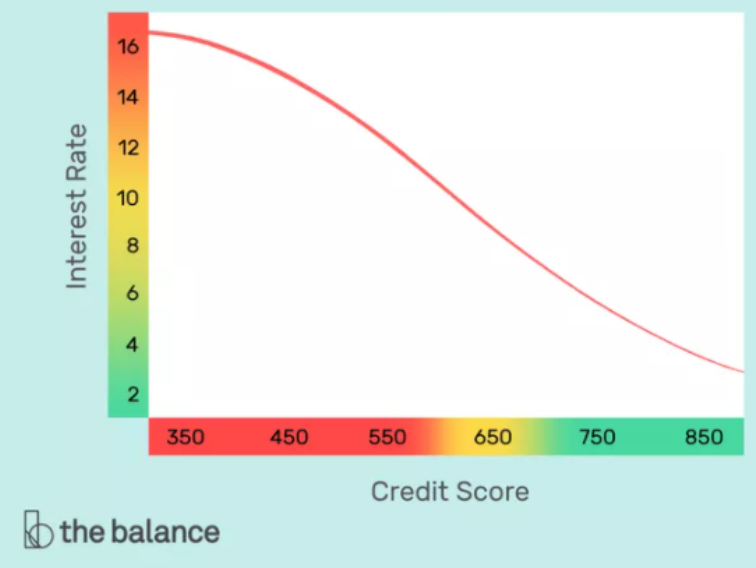

Regardless of the credit bureau, credit scores below 700 have a dramatic impact on interest rates. | Chart: thebalance.com

Although credit scores can fluctuate on a monthly basis, there are no quick fixes, especially if the borrower is in collections, behind in payments, or is facing judgements. In either of these scenarios, the borrower must pay their accounts in full to be brought up to date.

Credit Score Ranges

Using Equifax’s Risk 2.0 scoring model, credit scores in Canada typically broken down into five risk designations:

- Excellent (741-900): Borrowers with excellent credit likely have very few late payments on their credit report. They regularly pay down their balances in full and have a low credit utilization rate across all credit lines.

- Good (690-740): Borrowers with good credit scores rarely make late payments. Their credit utilization is likely low.

- Average (660-690): Mid-range credit scores are characteristic of borrowers who’ve made several late payments and who carry a higher debt load. They may have defaulted on a loan in the past.

- Below Average (575-659): Borrowers with a below average credit score likely ran into serious credit trouble in the past. They may have defaulted on multiple loans and have a high credit utilization.

- Poor (300-574): Poor credit scores are usually characteristic of borrowers who may have defaulted on multiple loans, carry a high debt load or may have declared bankruptcy.

How to Read the Credit Report

An Equifax credit report contains the following sections:

- Consumer Credit File

- Subject 1 (sections of the file that are populated and displayed)

- Consumer Alert

- Identification

- Inquiries

- Employment Information

- Summary of Credit

- Financial Statement

- Trade Information

- Banking Information

While all of this information should be reviewed carefully, the Consumer Alert, Inquiries and Summary of Credit sections are especially important.

The Consumer Alert section contains the credit score and Bankruptcy Navigator Index, which helps lenders identify the likelihood that the borrower declares bankruptcy over the next 12 to 24 months. The BNI ranges between 1 and 600, with higher scores associated with lower levels of risk.

The Consumer Alert section also includes up to three reason codes, which explain the type of information that had a negative impact on the borrower’s credit score.

The Inquiries section of the credit report will receive alerts if there have been three or more inquiries within the past 90 days. This section also includes the total number of inquiries since the file was established.

Different Types of Credit Reports

Although personal credit reports can be purchased online through Equifax or TransUnion, these documents are different from the reports pulled by lenders. The personal credit report does not disclose any judgments, collections, or bankruptcies—information that is readily available on lender reports. The scoring methodology used to generate consumer credit reports is also different from the one used by lenders. Brokers who advise their clients based on personal credit reports are working with incomplete information.

Conclusion

Credit reports are a powerful tool that lenders use to evaluate their clients. They are intended to scrutinize borrowers based on their perceived ability to repay. Ultimately, it is the lender who decides how they apply that information and whether to lend based on specific credit scores.